Table of Contents

ToggleFreelance Income Estimator & Tax Helper – Bangladesh (FY 2024–2025)

Let’s be real. Being a freelancer in Bangladesh is awesome! You get the freedom, the flexibility, and the chance to build your own path. But then comes that one word that can make any freelancer sweat: TAXES.

Navigating income tax in Bangladesh, especially when your earnings are dynamic and often from international sources, can feel like trying to solve a super-complex puzzle without all the pieces. What’s your actual taxable income? How much tax will you really pay? What deductions can you even claim? These questions often lead to confusion, stress, and sometimes, even delays in getting your finances sorted.

That’s why we at SahajTools are incredibly excited to introduce something truly special, built just for YOU – the Bangladeshi freelance community!

Introducing the “Freelance Income Estimator & Tax Helper (Bangladesh Specific)” – your new best friend for understanding and managing your freelance income tax in Bangladesh.

Freelance Income Estimator & Tax Helper

Bangladesh Specific Calculator for FY 2024-2025

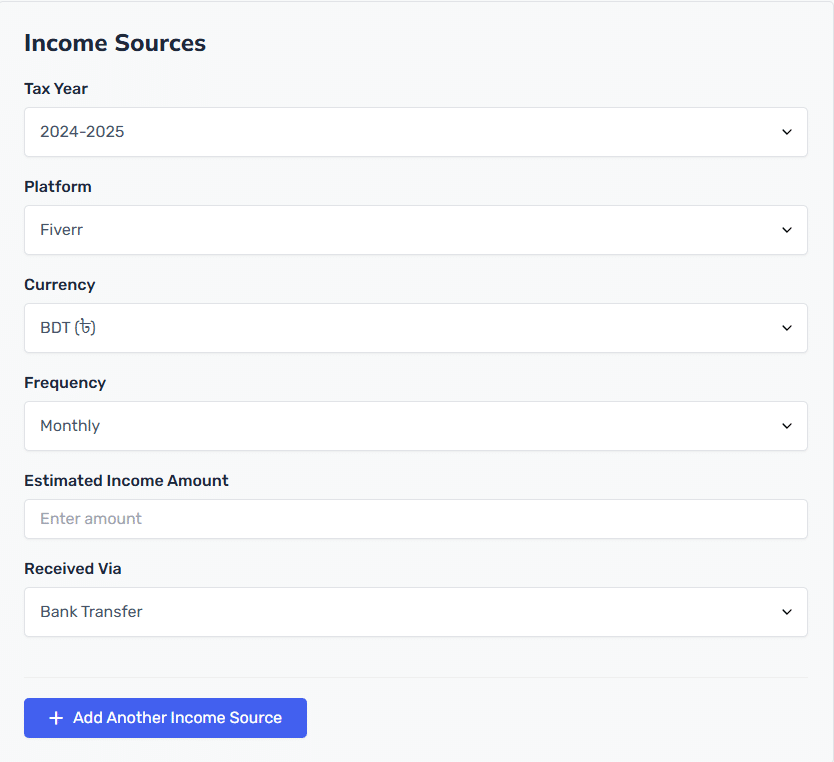

Income Sources

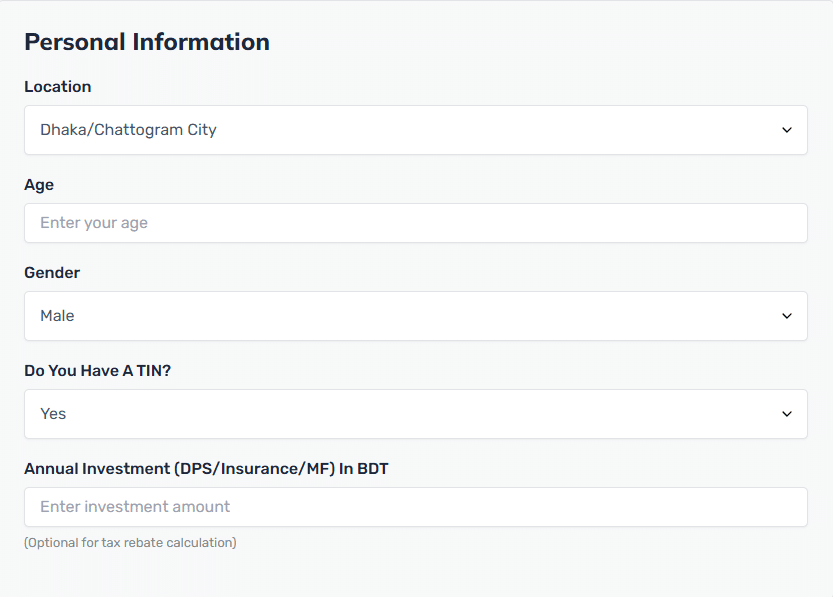

Personal Information

Calculating your tax estimate...

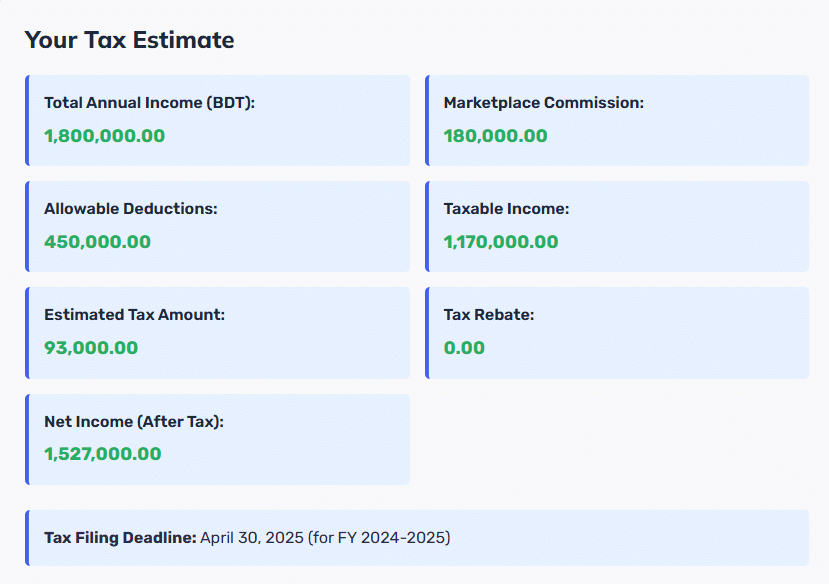

Your Tax Estimate

Why Did We Build This Tool, Especially for Bangladesh?

While there are many tax calculators out there, very few (if any!) are tailored specifically for the unique context of Bangladeshi freelancers. We saw a huge gap and a real need. Our goal was simple: to create a tool that is:

- Bangladesh-Specific: Accounts for NBR tax laws, slabs, and relevant deductions in Bangladesh.

- User-Friendly: No complex jargon, just clear inputs and understandable results.

- Accurate: Helps you get a reliable estimate for your tax liabilities.

- Empowering: Gives you the confidence to manage your finances better.

No more guessing games or spending hours trying to decipher tax codes. With our tool, you can get a clear picture of your potential tax liabilities in minutes!

Meet Your New Tax Helper: Features That Make Life Easier

We’ve designed this tool with you in mind. Every feature aims to simplify your tax estimation process.

1. Smart Income Sources Section

This is where you tell the tool about your hard-earned money!

- Multiple Income Streams: Whether you earn from Upwork, Fiverr, local clients, or direct international projects, you can add all your income sources.

- Platform & Currency Flexibility: Specify the platform you use and the currency you receive (e.g., USD, BDT).

- Frequency & Amount: Input your income frequency (monthly, yearly, or one-time) and the estimated amount. Our tool helps you consolidate this for a clearer picture.

2. Personalized Information Section

Your tax liability isn’t just about income; it’s also about your personal circumstances.

- Location Specifics: Input your district/city, as some tax rules can have regional nuances.

- Age & Gender: These factors are crucial for determining your tax-free threshold and specific exemptions under Bangladeshi tax law.

- Disability & Other Exemptions: Provision to include if you are a person with a disability or other special criteria that affect your tax.

- Investment & Donations: Crucially, you can add details about your investments (DPS, Insurance, SIP) and approved donations in BDT. These are key for claiming tax rebates!

3. Clear & Comprehensive Results Section (Your Tax Estimate Summary)

This is where the magic happens and you get the answers you’re looking for!

- Total Annual Income (BDT): See your consolidated earnings converted to BDT.

- Allowable Deductions: Understand what amounts are subtracted from your income based on your inputs.

- Estimated Tax Amount: Get a clear figure of your projected tax liability.

- Taxable Income: Know exactly what portion of your income is subject to tax.

- Tax Rebate: See the benefits of your investments and donations calculated as a tax rebate.

- Net Income (After Tax): The most important number – what you’re left with after taxes!

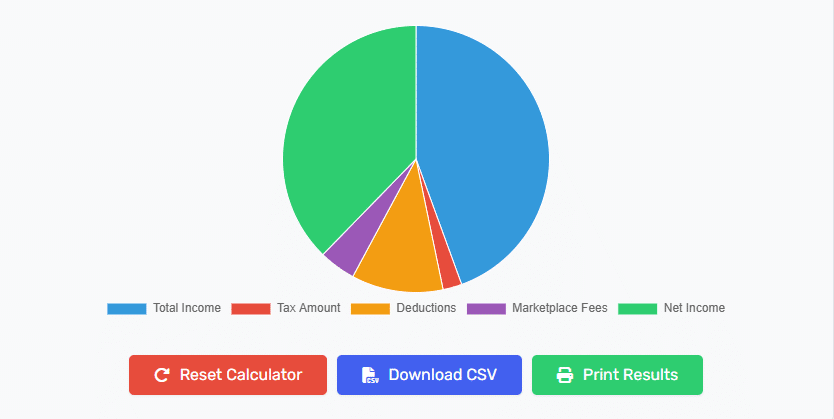

4. Interactive Visuals: Charts for Clarity

Sometimes, numbers can be overwhelming. That’s why we added visual aids!

- Detailed Chart Feature: Get a breakdown of how your income, deductions, and taxes are calculated step-by-step.

- Interactive Pie Chart: See a beautiful, easy-to-understand pie chart that visually represents the proportion of your income going towards tax vs. your net income. This helps you grasp the bigger picture instantly.

5. Convenient Action Buttons

We believe in putting control in your hands.

- Reset Calculator: Start fresh anytime with a single click.

- Download CSV: Want to keep a record or analyze your data offline? Download your results in a convenient CSV format.

- Print Result: Need a physical copy for your records or to share with an advisor? Just hit print!

- Save Result in Session Storage: Your inputs and results are temporarily saved, so if you accidentally close your tab or refresh, your data isn’t lost immediately (until you clear your browser session).

How to Use the Freelance Income Estimator & Tax Helper (In 3 Simple Steps!)

Using our tool is as easy as 1-2-3:

- Input Your Data: Fill in the “Income Sources” and “Personal Information” sections accurately. The more precise your inputs, the more accurate your estimate will be.

- Review Your Estimate: Once you’ve entered all the necessary details, the “Your Tax Estimate” section will automatically populate with all the important figures.

- Explore & Act: Check out the charts, download your results, or print them for your records. Use this estimate for your tax planning!

Why Is This Tool a Game-Changer for Bangladeshi Freelancers?

- Time-Saving: No more manual calculations or sifting through complex NBR circulars.

- Error Reduction: Automated calculations minimize the chance of human error.

- Better Financial Planning: Get a clear idea of your tax obligations, allowing you to plan your savings and investments effectively.

- Empowerment: Understand your tax situation better, reducing anxiety and increasing confidence.

- Compliance: While this is an estimator, it gives you a strong starting point for preparing for actual tax submission, helping you stay compliant with Bangladeshi tax laws.

Remember: The tax filing deadline for individuals for FY 2024-2025 is typically November 30, 2025 (subject to NBR announcements). Don’t wait until the last minute!

Tax Rules in Bangladesh for Freelancers (FY 2024–25)

TIN Holders get lower minimum tax rates and rebates.

Freelance income is taxable if it exceeds the threshold (BDT 350,000+ for males).

Allowable deductions include investment up to 25% of income (capped at BDT 1 crore).

Marketplace commissions can be deducted before tax is calculated.

For more information please visit the National Board Of Revenue Bangladesh (NBR)

Frequently Asked Questions (FAQ)

This tool is specifically designed for freelancers based in Bangladesh who earn income from various local and international sources.

No, this is an estimation tool developed by SahajTools to help freelancers understand their potential tax liabilities based on current Bangladeshi tax laws. It should not be considered legal or financial advice. Always consult with a qualified tax advisor for official tax filing.

The estimate is based on the inputs you provide and our interpretation of the latest Bangladeshi tax laws and slabs for individuals. Its accuracy depends on the correctness and completeness of your data. We strive to keep the calculations updated with current NBR guidelines.

Yes, you can download your results as a CSV file for your records using the "Download CSV" button. Your current session's data is also saved in your browser's session storage for convenience.

The tool is regularly updated to cover the most recent tax years. Currently, it's configured for the Tax Year 2024-2025 (FY 2023-2024 income).

The tool includes common allowable deductions and tax rebates for investments (like DPS, insurance, SIP) and approved donations. For more complex exemptions or specific situations, it's best to consult a tax professional.

Data Privacy

We do not store any user data. Everything runs securely in your browser session. Your income, personal info, and tax results are never sent to a server.

Your Feedback Matters!

We’re constantly striving to improve SahajTools to serve you better. If you have any suggestions, questions, or feedback regarding the Freelance Income Estimator & Tax Helper, please don’t hesitate to reach out! Your insights help us make this tool even more valuable for the Bangladeshi freelance community.

Email: hello@sahajtools.com