Table of Contents

ToggleZakat Calculator BD – Calculate Your Zakat Accurately in Bangladesh

Last updated: December, 2025

A zakat calculator BD is an online tool that simplifies your obligatory calculation by applying Shariah-based rules to your assets and liabilities within the context of the Bangladeshi economy and prevailing market rates.

The basic Zakat formula is:

Zakat Due = Total Zakatable Assets – Total Deductible Liabilities ×2.5%

Crucially, Zakat is only due if your Net Assets (Assets minus Liabilities) equal or exceed the minimum threshold, known as the Nisab. Because Zakat Nisab in Bangladesh is tied to the current market price of gold or silver, the calculator uses up-to-date values to provide an accurate assessment, avoiding the common pitfalls of manual calculation.

Calculate your Zakat according to Bangladeshi standards

Assalamu Alaikum. This comprehensive guide is designed for Bangladeshi Muslims—including salaried individuals, families, gold holders, and business owners—seeking to fulfill their annual Zakat obligation correctly. Navigating Zakat rules, especially concerning fluctuating Gold/Silver Nisab values and country-specific assets, can be complex. This is why a Bangladesh-specific zakat calculator is essential: it applies the universal 2.5% rate to your local assets and liabilities according to authentic Islamic principles, helping you determine your precise Zakat Due.

Zakat (or zakah) is one of the five pillars of Islam, an obligatory act of worship that requires purifying one’s wealth by giving a prescribed portion to eligible recipients. This article will serve as both a detailed Zakat education guide and a practical tool explanation page for an online zakat calculator BD, ensuring your calculation (or jakat hisab) is both Shariah-compliant and locally relevant.

What Is Zakat? Understanding Jakat Hisab in Bangladesh

Zakat is not merely a tax; it is an act of purification of wealth and a spiritual pillar of Islam. The word “Zakat” literally means “to purify” or “to grow”.

Who Must Pay Zakat?

Zakat is obligatory upon every sane, adult Muslim who meets two essential conditions:

- They must possess wealth equal to or exceeding the Nisab threshold.

- This wealth must have been in their possession for one full lunar year (Hawl).

Why Correct Jakat Hisab Matters

Performing the correct jakat hisab is a religious requirement. Errors can lead to underpaying, leaving one’s wealth unpurified, or overpaying due to a lack of clarity on deductible liabilities. Given the complexities of modern finance involving bank deposits, shares, and business inventories, a precise and educated calculation is paramount for Bangladeshi Muslims.

Difference Between Zakat and Charity (Sadaqah)

While both are forms of giving in Islam, Zakat is an obligatory annual due, calculated at a fixed rate (2.5%) on specific wealth categories, and must be distributed to eight defined categories of recipients. Sadaqah (charity) is a voluntary act of giving and can be performed at any time and in any amount.

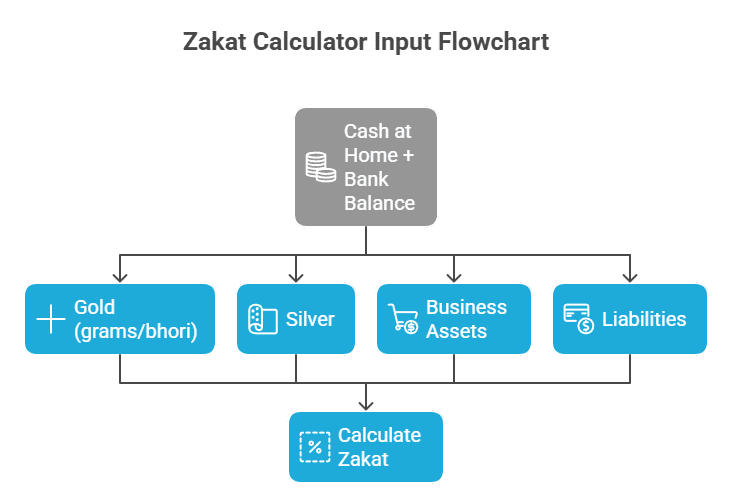

How the Zakat Calculator Works

Our Zakat Calculator is designed to simplify the complex rules of Zakat into a simple, three-step process, adhering strictly to Hanafi Fiqh principles, which are widely followed in Bangladesh.

- Calculate Total Assets: Sum the current market value of all your Zakat-able assets, including: Gold, Silver, Cash (in hand, bank accounts, digital wallets like bKash/Nagad), Investments, and Business Inventory.

- Determine Net Assets: Deduct your immediate liabilities (debts, loans, and payables due within the current lunar year) from your Total Assets.

- Check Nisab &Calculate Zakat: The calculator compares your Net Assets to the chosen Nisab Threshold (Gold or Silver) in BDT. If Net Assets ≥ Nisab, Zakat is due at 2.5% (Lunar Year) or 2.58% (Gregorian Year).

Take the guesswork out of your savings. Our Money Market Calculator goes beyond simple estimates with powerful tools like APY and Nominal APR conversion, plus an interactive growth chart to visualize your progress. Whether you’re building toward a near-term milestone or mapping out long-term financial goals, this calculator delivers the insight you need to make confident, informed choices with your money.

Zakat Nisab Bangladesh – Minimum Threshold Explained

The Nisab is the minimum threshold of wealth that a Muslim must own for one complete lunar year before Zakat becomes obligatory. Wealth below the Nisab is not subject to Zakat.

Gold vs. Silver Nisab

In Shariah, the Nisab is defined in terms of either gold or silver:

- Gold Nisab: The market value of 87.48 grams (7.5 tolas) of pure gold.

- Silver Nisab: The market value of 612.36 grams (52.5 tolas) of pure silver.

For the purpose of calculating Zakat for mixed assets like cash, investments, and business stock, most scholars recommend using the Silver Nisab because it results in a lower monetary threshold, thus benefiting a larger number of poor recipients.

Why Nisab Values Change

The monetary value of Zakat Nisab Bangladesh is not fixed. It directly depends on the fluctuating international and local market prices for gold and silver. For example, a Zakat calculator must clearly mention where Nisab values may vary based on the gold/silver market price at the time of calculation. You must use the prevailing market rate on the day you choose to calculate your Zakat.

Our Age Difference Calculator gives you the answer in seconds. Whether it’s a friend, partner, or even your favorite celebrity, discover the exact gap instantly and satisfy your curiosity with ease.

How to Calculate Zakat Step-by-Step

A clear jakat hisab is essential for fulfilling this obligation correctly27. Follow these five steps to arrive at your Zakat liability:

Step 1: Confirm Nisab Eligibility

First, calculate the total current monetary value of all your Zakatable Assets (Gold, Silver, Cash, Bank Deposits, etc.). If this total is equal to or greater than the current Nisab Threshold (Gold or Silver standard), you are obligated to pay Zakat, provided you have possessed the wealth for a full lunar year (Hawl).

Step 2: List Zakatable Assets

Tally the current market value of all wealth that is eligible for Zakat.

What to Include | What to Exclude |

Cash in hand and bank deposits | Personal residence, vehicle, and clothing |

Value of gold and silver jewelry/bullion | Tools, machinery, and equipment used in business |

Business inventory/stock at retail price | Money owed to you that is unlikely to be collected (bad debt) |

Collectible receivables (money owed to you) | Zakat that was due but not paid in previous years |

Stocks, shares, and investment funds | Personal items that are not for trade |

Step 3: Subtract Eligible Liabilities

Deduct any short-term, legitimate debts that are due to be paid within the next lunar year (e.g., credit card debt, short-term loans, or installments due).

Net Zakatable Wealth = Zakatable Assets – Eligible Liabilities

Step 4: Apply Zakat Rate

If the Net Zakatable Wealth is greater than the Nisab threshold, you must pay Zakat at the rate of 2.5%.

Step 5: Get Zakat Due

The final result is your Zakat obligation.

Zakat Due = Net Zakatable Wealth × 2.5%

Zakat Calculator BD – How This Online Tool Works

Our Bangladesh Zakat Calculator simplifies the complex accounting process into a few easy steps. It accurately calculates the Zakat obligation based on the current standards in Bangladesh.

Key Inputs Required by the Tool:

- Cash at Home + Bank Balance: The total of readily available money you possess.

- Gold (grams/bhori): The weight of all your gold, along with its current price per gram.

- Silver: The weight of all silver and its price.

- Business Assets: The current retail/sale value of your business inventory and stock, plus money owed to you (receivables).

- Liabilities: Any legitimate, short-term debts or installments due within the next 12 lunar months.

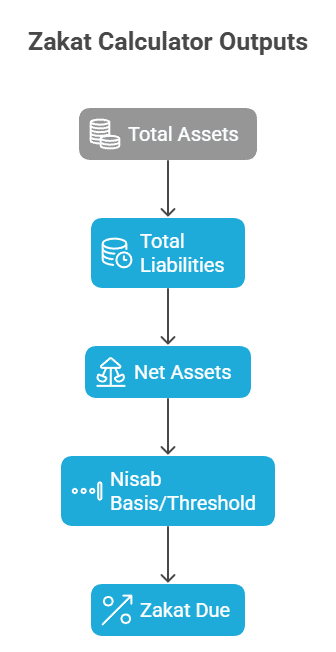

Tool Outputs:

The calculator provides a clear, transparent breakdown of your results:

- Total Assets: The sum of all Zakatable Assets.

- Total Liabilities: The sum of all Eligible Debts.

- Net Assets: The resulting wealth upon which Zakat will be applied.

- Nisab Basis/Threshold: The value you must meet for eligibility.

- Zakat Due: The final Zakat obligation at 2.5%.

Gold Zakat Calculator – Zakat Calculator on Gold in Bangladesh (Gram + Bhori)

Gold is one of the most common assets for Zakat calculation in Bangladesh, often in the form of jewelry. This is why the Zakat Calculator on Gold in Bangladesh is one of the most frequently used features.

Gold Units: Gram and Bhori/Vori

In Bangladesh, gold is often measured in Bhori (or Vori). For calculation purposes, remember the following conversion:

1 Bhori/Vori ≈ 11.664 grams

Our calculator allows you to input the weight in grams, which is standard for most international Zakat calculations.

Is Zakat Due on Gold Jewelry?

The treatment of gold jewelry can vary based on scholarly opinions.

- View 1 (Common in BD): Zakat is due on gold jewelry once it reaches the Nisab (85 grams), regardless of whether it is worn or stored.

- View 2 (Minority/Alternative): Zakat is only due on gold that is considered “excess wealth” (stored, not worn). If it is worn regularly, it may be exempted unless it is excessively high in weight.

We advise users to follow the opinion of their trusted scholar, but for the safest and most commonly accepted calculation, we include all gold above the Nisab.

Worked Example: Gold, Cash, and Debts (Scenario A)

Mr. Rahim, a salaried individual, has the following assets and liabilities on his Zakat anniversary:

Item | Value (BDT) | Asset/Liability |

Gold (10 Bhori ≈ 116.64g × BDT 9,714/g) | BDT 1,133,083 | Asset |

Bank Deposits | BDT 500,000 | Asset |

Personal Loan Payable (Due this year) | BDT 150,000 | Liability |

Step | Value (BDT) | Notes |

Total Assets | 1,133,083 + 500,000 = BDT 1,633,083 | Sum of Gold and Bank Deposit |

Total Liabilities | BDT 150,000 | Personal loan installment due this year |

Net Zakatable Wealth | 1,633,083 – 150,000 = BDT 1,483,083 | Must be ≥ Nisab to continue |

Zakat Due (2.5%) | 1,483,083 × 0.025 = BDT 37,077.08 | Final Zakat obligation |

Bangladesh Zakat Calculator vs Manual Jakat Hisab

The decision to use the Bangladesh Zakat Calculator or perform a manual jakat hisab depends on your preference for speed and accuracy.

Method | When it is Useful | Reinforcement |

Manual Jakat Hisab | When you want a deeper personal understanding of the components of your wealth. | Useful for learning and double-checking, but prone to math errors |

Online Calculator | When your assets include complex factors like varying gold rates, investments, or business inventory. | Safer against simple math errors and provides a structured output. |

This tool is designed to provide you with reliable calculation support; it is not an official religious verdict (fatwa).

Zakat Calculator BD PDF – Download, Print, and Keep Records

It is crucial to maintain clear records of your Zakat calculation for personal budgeting, transparency, and future reference.

Our calculator includes the option to generate a Zakat calculator BD PDF summary. This feature allows you to:

- Download: Save a PDF document of your calculation breakdown (Inputs, Outputs, Net Wealth, Zakat Due).

- Copy: Easily copy to clipboard the summary for easy to past anywhere.

- Record: Keep a transparent record of your jakat hisab for the year, a common and expected feature among reputable calculators in Bangladesh.

Our Academic Calculators

FAQs – Zakat Calculator BD & Zakat Rules

To calculate Zakat, you must total all Zakatable assets, deduct all immediate liabilities, and then pay 2.5% of the resulting Net Assets, provided they meet the Zakat Nisab Bangladesh.

The Zakat Nisab Bangladesh is the current market value of either 87.48 grams of gold or 612.36 grams of silver. Most scholars advise using the lower silver value for general wealth.

You calculate gold Zakat by finding the total market value of your gold holdings (based on weight and current price) and paying 2.5% of that value, provided your total Net Assets meet the Nisab. Use the gold zakat calculator feature for precision.

Yes, a well-developed online zakat calculator is highly accurate because it automates the 2.5% calculation and checks the Nisab threshold instantly, minimizing human error.

Assets included in jakat hisab are cash, bank deposits, gold, silver, investments, and business inventory or stock held for trade.

A reputable zakat calculator BD is Shariah compliant if its underlying logic is based on authentic Islamic principles and the 2.5% rule, and it correctly incorporates the Nisab threshold.

According to the Hanafi madhhab, Zakat is generally due on gold and silver jewellery once it meets the Nisab. It is best to consult a local scholar for a definitive answer based on your specific situation.

You should download the Zakat calculator bd pdf for a comprehensive, printable, and offline reference guide that clarifies asset categories and aids in manual data compilation before using the online tool.

Legal & Religious Disclaimer

Zakat calculations are intrinsically linked to the current Nisab values. Since gold and silver prices vary constantly, the figures generated by this zakat calculator BD are intended as a guidance tool based on the data you provide and the latest market context. Always consult a qualified Islamic scholar or local Zakat organization for complex financial scenarios or for the definitive ruling on highly specialized assets.